Asian stock markets mostly swung back into positive territory Wednesday while oil prices tumbled again, as the wild swings that have marked the start of the year showed no signs of abating.

After a sharp sell-off on Tuesday, equities traders were given a welcome lead from New York and Europe, where markets climbed on the back of a rally in crude.

But experts said the volatility that has stalked world trading floors this year was unlikely to end any time soon, and oil prices sank over concerns of another rise in US stockpiles.

Trillions of dollars has been wiped off valuations since the start of the year, with the slump in crude prices -- to 12-year lows -- and China's ongoing economic struggles driving the sell-off.

Hopes that central bankers in Europe and Japan would loosen monetary policy fuelled a two-day surge, but that was soon erased in Asia by Tuesday's falls.

"We could see a short-term rally," Angus Nicholson, an analyst at IG Markets in Melbourne, told Bloomberg News.

"A lot of the markets around are trading at such low levels that they tend to draw buyers back into the market. We won't be calling a bottom just yet. We're probably going to see weak economic data from China in the first quarter and that's going to add pressure on oil prices."

Japanese shares led the advances Wednesday, with the Nikkei up 2.7 percent by the close.

The gain was helped by car giant Toyota, which announced it sold more than 10 million cars last year and kept the title of world's biggest automaker.

Hong Kong put on one percent in the afternoon and Seoul ended 1.4 percent higher. There were also healthy gains in Singapore and Jakarta, while Manila soared more than three percent.

- Crude talks scepticism –

However, Shanghai fell 0.5 percent, extending the more than six percent dive Tuesday, as data showed profits at China's industrial giants had fallen 4.7 percent last month, extending November's fall and highlighting the ongoing weakness in the economy.

Over the whole year profits dropped 2.3 percent, which analysts said marked the first contraction since 1998.

Sydney fell 1.2 percent as investors returned from a one-day public holiday.

In the technology sector, shares in Apple suppliers such as Taiwan's Foxconn showed a muted reaction to news the US giant had seen the slowest growth in iPhone sales ever during October-December. Foxconn ended 0.7 percent higher.

Oil prices tumbled, with US benchmark West Texas Intermediate down 2.6 percent and Brent off two percent.

Both contracts had surged on Tuesday on talk that major producers Saudi Arabia and Russia could coordinate cutting output to support prices, even though some market-watchers expressed scepticism.

There are also expectations a report later Wednesday will show another surge in US stockpiles, adding to the growing global glut that has helped batter prices.

Emerging-market currencies rose against the greenback, with the Australian dollar up 0.5 percent as a pick-up in inflation softened expectations of a cut in interest rates any time soon.

The South Korean won was 0.1 percent higher and Indonesia's rupiah 0.1 percent up. Malaysia's oil-dependent ringgit added 0.9 percent.

Traders are now focusing on the US Federal Reserve, which ends a policy meeting Wednesday. Speculation is mounting it will take a dovish stance on interest rates after lifting them in December for the first time in nearly a decade.

The Japanese central bank winds up its own two-day gathering on Friday.

In early European trade London and Frankfurt each slid 0.4 percent and Paris dipped 0.2 percent.

- Key figures around 0830 GMT –

Tokyo - Nikkei 225: UP 2.7 percent at 17,163.92 (close)

Shanghai - Composite: DOWN 0.5 percent at 2,735.56 (close)

Hong Kong - Hang Seng: UP 1.0 percent at 19,052.45 (close)

London - FTSE 100: DOWN 0.4 percent at 5,885.4

Euro/dollar: DOWN at $1.0862 from $1.0868 Tuesday

Dollar/yen: DOWN at 118.10 yen from 118.42 yen

New York - Dow: UP 1.8 percent at 16,167.23 (close)

© AFP

You are viewing the old site.

Please update your bookmark to https://eng.mizzima.com.

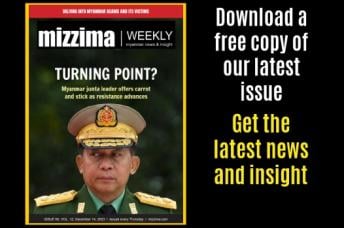

Mizzima Weekly Magazine Issue...

14 December 2023

New UK Burma sanctions welcome...

13 December 2023

Spring Revolution Daily News f...

13 December 2023

Spring Revolution Daily News f...

12 December 2023

Spring Revolution Daily News f...

11 December 2023

Spring Revolution Daily News f...

08 December 2023

Spring Revolution Daily News f...

07 December 2023

Diaspora journalists increasin...

07 December 2023

EU official bemoans 'unpredictablity' of Chinese law on Beijing trip